|

|

| Todd Davidson |

Great Expectations,

Greater Possibilities

The growth of Tufts’ endowment through sound management and generous gifts puts ambitious goals within reach

by

Mary Jo Curtis

Sally Dungan remembers her first impression of Tufts in 2002. “I knew this would be the greatest job in the world,” said Dungan, a candidate for the university’s first chief financial officer. “Here was an opportunity to grow with the institution and to be able to take things to the next level. I knew I could make a difference.”

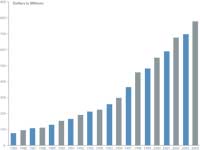

That optimism about Tufts’ financial future has found fertile ground. There is no better evidence than the university’s endowment, the permanent capital of the university. During the past three years, it has grown from $657 million to $880 million as of June 30 this year. Net performance has been favorable, returning 9.5 percent for fiscal year 2005. Compared to other colleges and universities, Tufts’ rate of return was in the top quartile for the last five years.*

This growth, particularly in a challenging economic climate, is welcome news for President Lawrence S. Bacow, who is already banking on Tufts’ continued success. “Our progress is remarkable,” said Bacow, who joined the university in 2001. “It’s been exciting to see how Tufts has gained ground through wise management and generous gifts. We’ve also been prudent during a time when other schools might have taken greater risks. We have kept the long view and it has paid off. The question now is not if we will break the billion-dollar endowment milestone, but when.”

Indeed, a recent $25 million gift from Pierre Omidyar, A88, and Pam Omidyar, A89, puts that goal within sight. The gift endows undergraduate scholarships and is also a challenge grant to inspire others to contribute toward a $200 million endowment to make the university a “need-blind” institution. As a need-blind university, Tufts could admit students solely on the basis of academic excellence without considering their financial need. Currently, Tufts is forced to turn away some outstanding applicants because they require more financial aid than the university is able to provide.

| Two Decades of Growth |

|

|

|

| |

“In the past, Tufts could not have dreamed of becoming need blind,” said Bacow. “But today, the university is in a far stronger financial position, and this goal is within our grasp. We are committed to making a Tufts education accessible to every qualified student who wishes to attend, regardless of the ability of the family to pay. I don’t think Tufts should be a school only for the privileged.”

The endowment will never be spent down because it has a “perpetual time horizon.” That means while current spending supports current faculty and students, the endowment is also managed to ensure income for future generations.

Colleges and universities, both public and private, are fortunate when donors show foresight by helping build these permanent investment accounts. The larger the endowment, the more income can be generated to ensure institutional vitality well into the future.

At Tufts, an endowed fund can be established with a minimum commitment of $25,000. These funds are invested forever in the endowment pool, where they grow over time. A portion of returns are plowed back into the fund, while an annual income is distributed to help support donors’ philanthropic objectives, such as named professorships, scholarships, library acquisitions, and academic programs.

Compared to its peer schools, Tufts is a late bloomer in building its endowment, according to Steve Manos, executive vice president. “Tufts didn’t have a serious capital campaign until the late 1970s when Jean Mayer was president,” Manos said. “We started far behind our peers, but we’ve been on a roll since. Over the past 25 years Tufts conducted three capital campaigns. Generous donors contributed $1 billion, of which $312 million went toward building the endowment.”

With the arrival of President Bacow, Tufts created the Tufts University Investment Office. Sally Dungan, formerly head of the pension management department for the U.S. division of Siemens, now heads a staff of six, which includes three other investment professionals.

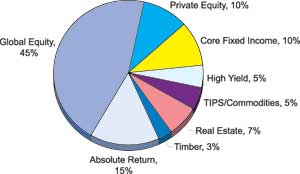

As CIO, she reports to the Investment Committee of the Board of Trustees. The committee of volunteers, chaired by Nathan Gantcher, A62, trustee emeritus and former chairman of the Board of Trustees, draws on the broad expertise of investment managers and others. Dungan develops and manages an asset allocation plan approved by the committee, aiming for “the highest possible level of return for an acceptable level of risk.”

| |

Asset Allocation |

| |

|

| |

This balanced portfolio is intended to grow by re-investing a portion of the returns and adding new contributions from alumni and friends. This, coupled with an annual spending rate between 4.5 and 5.5 percent of the endowment’s market value, prevents inflationary erosion and sustains its purchasing power over time.

In fiscal year 2005, earnings from the endowment were able to support approximately ten percent of the university’s total $260 million annual operating budget. This additional revenue stream can slow increases in tuition, which currently funds ten percent of the annual budget. However, endowment dollars aren’t just seen as budget relief. They are designated for areas that build an edge of excellence and fuel a school’s move from “good to great.”

Tufts has adhered to conservative fiscal policies that proved particularly prudent during the dot-com boom in the 1990s. According to Manos, Tufts was cautious at the time, while many schools invested heavily in alternative investments given high valuations. Consequently, when everything came crashing down, they found themselves retrenching.

“Tufts was able to hold a steady course,” he said. “The university is now well positioned to improve its investment return. When endowment assets top $1 billion, we will be able to participate in superior investment opportunities that simply aren’t open to schools with smaller endowments. We’re getting closer to that $1 billion benchmark, which will improve our chances to increase returns.”

Endowment assets are often measured in the context of student population size to illustrate the capability of its resources, a metric called “value per student.” Tufts falls 134th among 514 schools, with $84,183 per undergraduate. Considering how high the university rates on other quality measures, such as SAT scores and by U.S. News & World Report (currently, Tufts ranks 27th among national universities), Tufts is undercapitalized.

A stronger endowment will help address this disparity. It will support a greater share of costs, relieving some of the pressure for increasing tuition to keep a balanced budget. Tufts also will be better positioned to address two key priorities: increasing financial aid resources for all students and bolstering resources for attracting and retaining top faculty.

Substantially increasing the endowment will give Tufts the resources to successfully compete for the very best students. Financial aid remains the single greatest challenge facing schools across Tufts as they seek to temper the expense of tuition with generous scholarships. “Tufts must be able to offer competitive financial aid packages,” said Bacow. “All our schools are grappling with this difficulty.”

Tufts currently meets the full financial need of every admitted student, but each year turns away a number of extraordinary applicants because the university cannot meet their needs. In fact, Tufts is also the only one of its peer institutions that cannot offer undergraduate applicants need-blind admissions. To do so requires the infusion of resources: Bacow estimates an additional $175 million must be added to the endowment to meet this objective alone, an effort jump-started by the Omidyars’ recent gift.

University leaders also are aware of the need to recruit and retain a distinctive faculty. In addition to providing competitive compensation, building an excellent faculty requires top-notch facilities, including laboratory space in the sciences, performance spaces in the arts, access to libraries and archives in the social sciences, funding for travel to professional meetings and for scholarly work, and opportunities for faculty development.

At the undergraduate level, supporting faculty also translates into a continued commitment to the liberal arts tradition. Today, 99 percent of classes are taught by professors, the student/total faculty ratio is a low 8:1, and the average class size is about 20 students. “We want to maintain the close, intimate relationship between faculty and student that has always been the hallmark of a Tufts education,” said Bacow.

Alumni and friends are responding well to the challenge, said Bacow, noting that Tufts this past fiscal year exceeded the $100 million mark in fundraising for the second year in a row; in fact, the past three years have been the best in Tufts’ history. This year, he expects, Tufts will set another record.

“Even though we are not officially in campaign mode, we are stepping up our efforts to engage our strongest supporters,” he added. “We are talking to them about both the challenges and the opportunities. They clearly understand what is possible.”

That success, he said, will always depend on great stewardship of the resources that have been provided to the university by its donors.

“The quality of a university is directly related to the quality of its students and faculty,” said Bacow. “Everything we do is measured against how we support those objectives. With additional endowment growth, Tufts can only become an even better institution.” |